In a market still feeling the weight of elevated interest rates and tighter lending, Congress just delivered something rare — real momentum for commercial real estate.

The One Big Beautiful Bill (H.R. 1) is sweeping, yes — but for CRE, it’s also highly targeted. The bill revives and strengthens several key tools that matter most to developers, investors, and dealmakers. Here are the five provisions we believe will make the biggest difference in the months ahead:

1. Bonus Depreciation Returns

The bill fully restores 100% bonus depreciation through 2029, allowing investors to immediately write off qualifying property improvements and capital equipment.

Why this matters: This supercharges after-tax cash flow and accelerates returns — especially critical for value-add, ground-up, and repositioning projects.

Who Benefits: Developers, syndicators, and asset managers with heavy upfront CapEx.

2. QBI Deduction Made Permanent

The 20% Qualified Business Income deduction for pass-through entities (LLCs, LPs, S-corps) is not only extended — it’s smoothed out with higher phase-out thresholds.

Why it Matters: Locks in lower effective tax rates for thousands of real estate professionals and ownership groups.

Who Benefits: Brokers, GPs, family offices, and small-to-mid-sized sponsors — the backbone of private CRE.

3. Opportunity Zones Recharged

The OZ program now has rolling 10-year designations and broader investor access — offering a second wind for this once-rushed initiative.

Why it matters: Revives interest in long-hold, tax-deferred development in overlooked but rising markets.

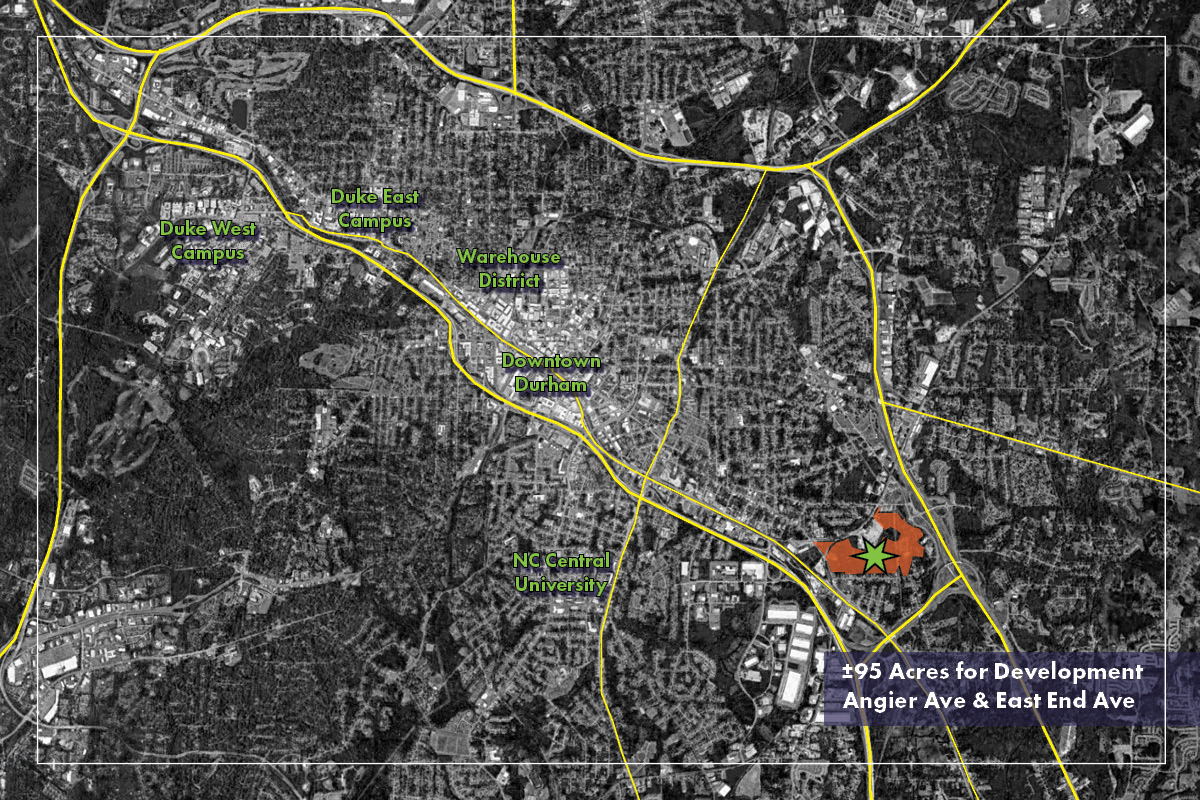

Who Benefits: Land assemblers, urban infill developers, and forward-thinking investors in places like East Durham and Southeast Raleigh.

4. Affordable Housing Gets a Lift

The bill boosts 9% LIHTC allocations and relaxes bond-financing thresholds for 4% credits — key tools in workforce housing.

Why it Matters: More projects pencil, particularly in metros where land and construction costs have outpaced rents.

Who Benefits: Multifamily developers, nonprofit partners, and municipalities tackling housing needs with public-private solutions.

5. REIT & 1031 Flexibility Preserved

Section 1031 exchanges remain untouched, and REITs gain more room to operate with an increased taxable subsidiary limit.

Why it Matters: Keeps foundational tax strategies intact and gives portfolio managers more room to scale.

Who Benefits: Institutional investors, legacy owners, and growing real estate platforms.

Raleigh-Durham Outlook

The Triangle was already outperforming and now it has legislative tailwinds behind it. With strong fundamentals and new incentives, we expect to see:

- Accelerated investor activity across suburban and infill sites

- Increased land sales tied to LIHTC and OZ redevelopment

- Renewed appetite for value-add and ground-up projects

What’s Next

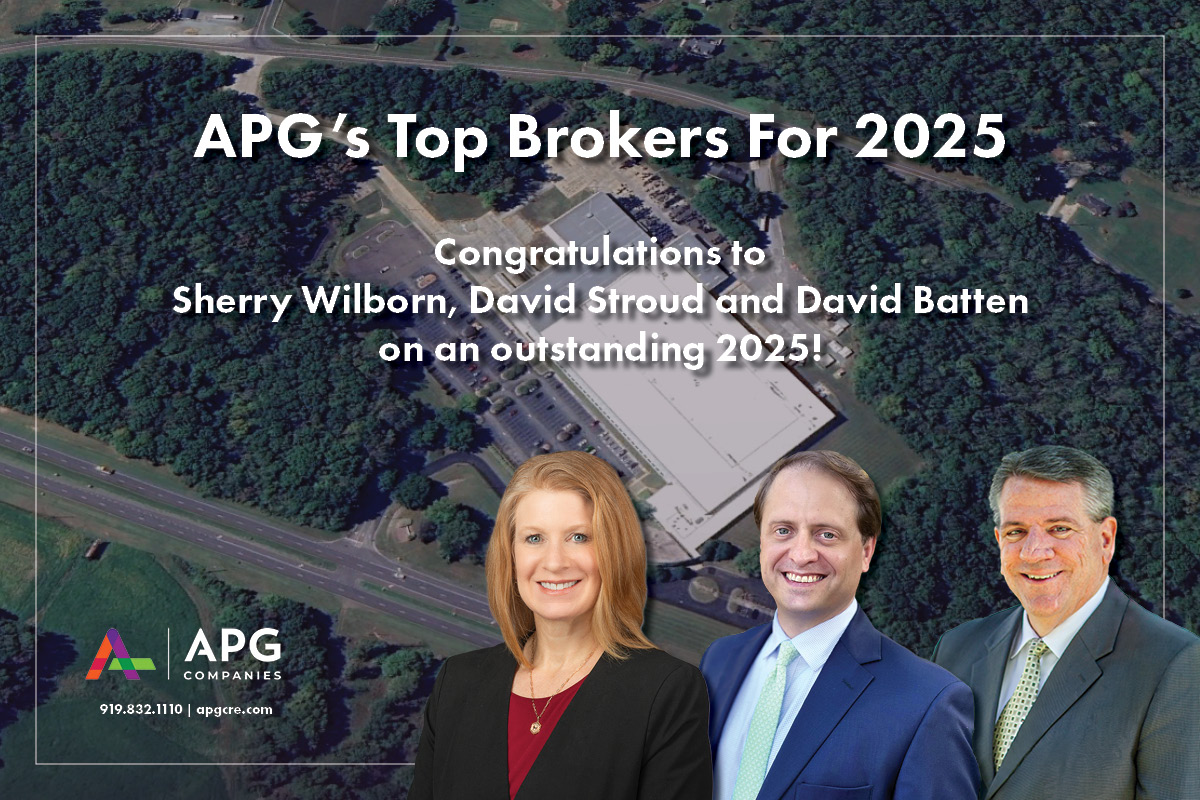

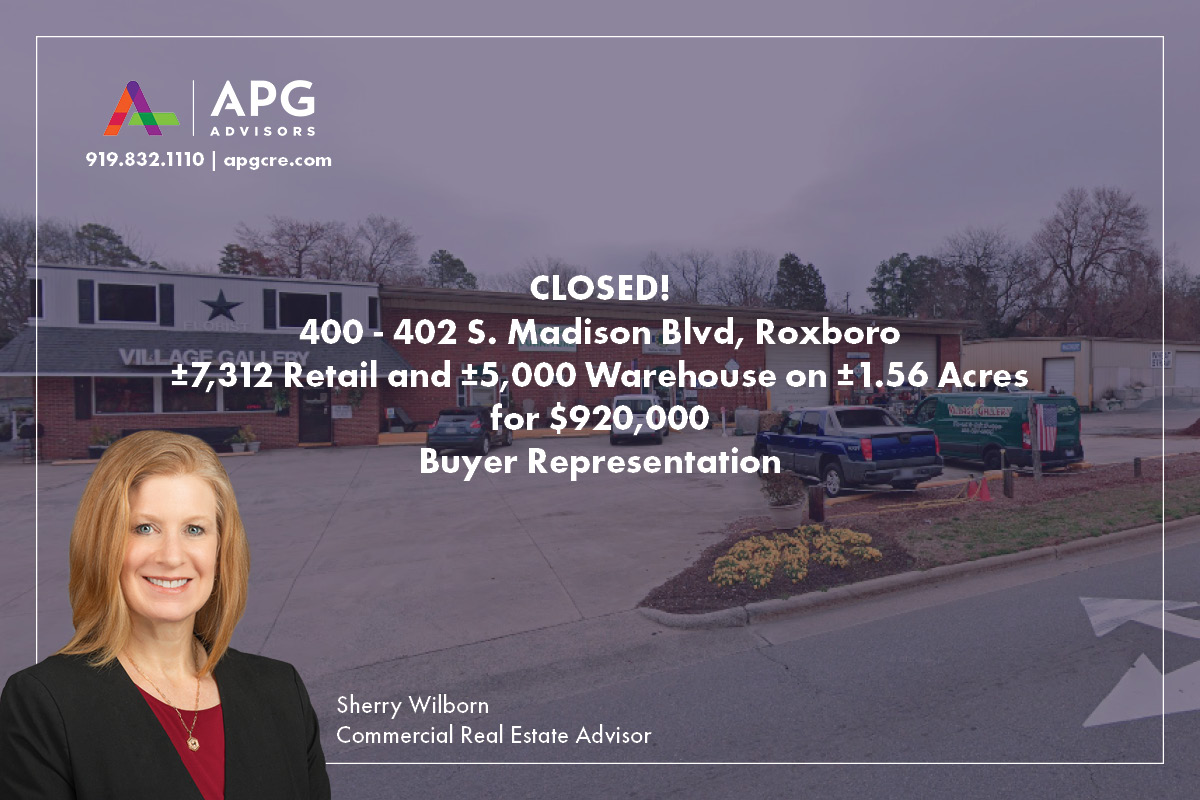

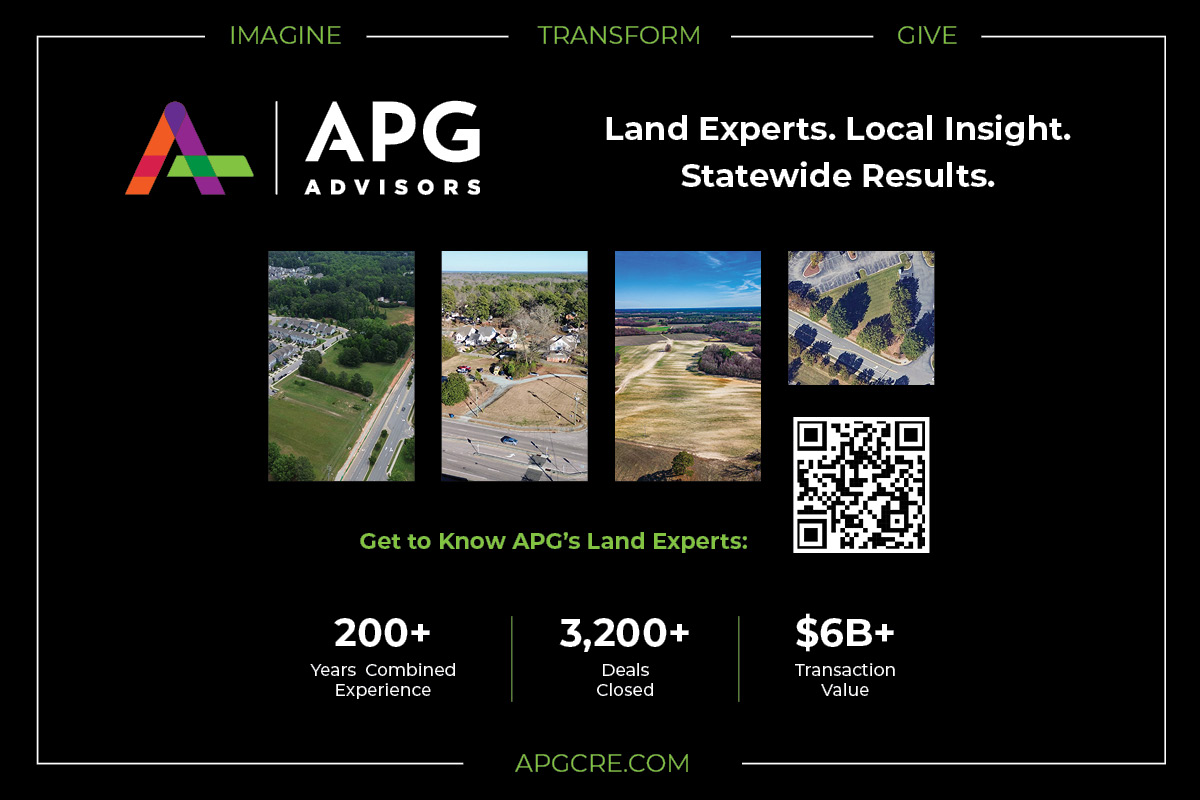

At APG Advisors, our brokerage professionals bring deep market knowledge to guide clients across land, office, industrial, multifamily, and retail.

At APG Capital, we offer investment expertise — structuring deals, deploying capital, and managing long-term growth strategies.

Let’s talk about how policy becomes opportunity.

www.apgcre.com

Recent Posts

January 16, 2026

January 13, 2026

December 22, 2025

December 17, 2025

December 4, 2025

November 19, 2025

November 3, 2025

October 24, 2025

October 8, 2025

October 2, 2025

September 11, 2025

September 4, 2025

August 28, 2025

August 8, 2025

August 7, 2025

July 2, 2025

June 19, 2025

June 18, 2025

May 12, 2025

May 5, 2025

April 4, 2025

March 24, 2025

February 21, 2025

February 13, 2025

January 31, 2025

January 24, 2025

January 7, 2025

January 3, 2025

December 11, 2024

November 19, 2024

November 7, 2024

November 6, 2024

October 31, 2024

September 13, 2024

September 12, 2024

August 28, 2024

August 9, 2024

August 2, 2024

July 9, 2024

June 13, 2024

May 31, 2024

May 31, 2024

April 22, 2024

April 16, 2024

April 10, 2024

March 29, 2024

February 28, 2024

February 22, 2024

December 14, 2023

October 31, 2023

October 12, 2023

August 9, 2023

May 24, 2023

April 25, 2023

March 16, 2023

February 9, 2023

January 23, 2023