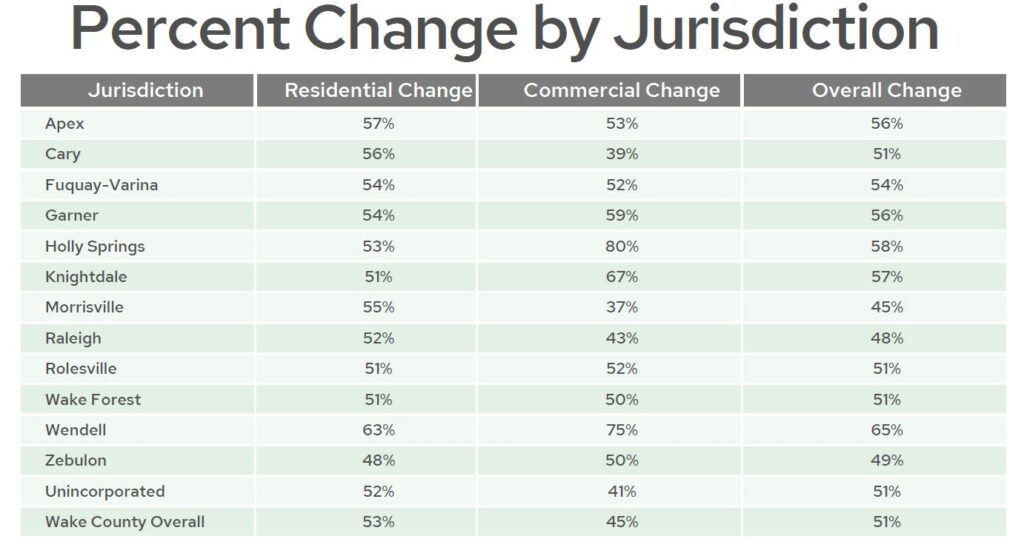

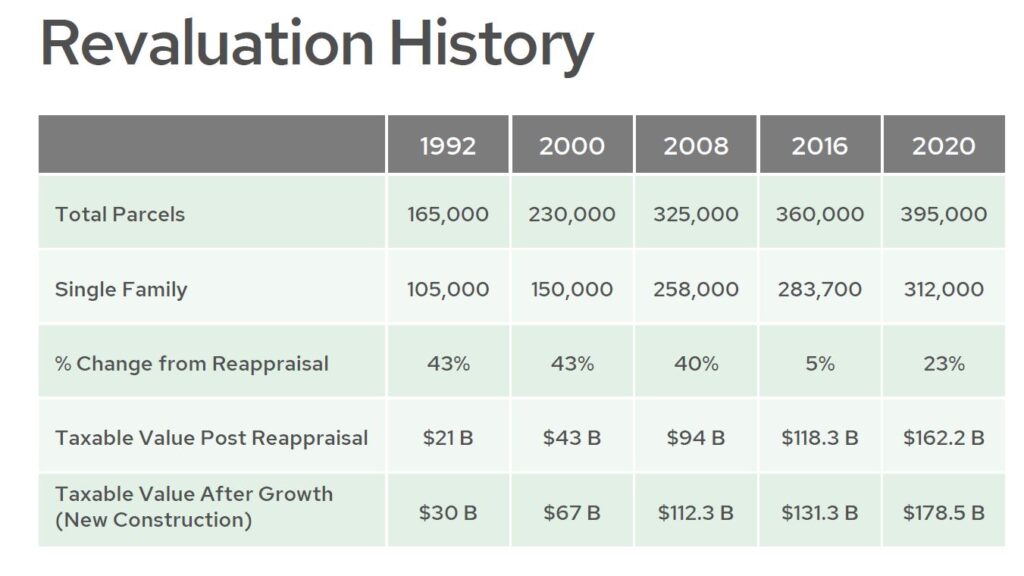

Following a two-year process of market analysis and field visits, the property values of more than 425,000 Wake County properties were updated to bring property values into alignment with fair market value as of January 1, 2024.

North Carolina law requires all counties to revalue real property at least once every 8 years. Wake County transitioned from an 8-year to a 4-year revaluation cycle in 2016.

As of January 1, 2024 Wake County had a total of 427,527 parcels, of which 23,641 are commercial parcels.

Commercial Real Property Tax Base before Revaluation: $ 56.4B

Commercial Real Property Tax Base after Revaluation: $ 81.9B

Residential Real Property Tax Base before Revaluation: $124.5B

Residential Real Property Tax Base after Revaluation: $190.5B

Commercial Value Drivers:

Mini Storage 113%

Industrial 79%

Apartments 55%

Retail 33%

Restaurant 29%

Hotels 22%

Office 20%

“The increase in values is unprecedented for Wake County, but we’re confident the updated assessed values reflect fair market value,” said Wake County Tax Administrator Marcus Kinrade, citing how the county’s continued growth, high housing demand and limited supply triggered rapidly increasing real estate values over the last four years.

Recent Posts

July 9, 2024

June 13, 2024

May 31, 2024

May 31, 2024

April 22, 2024

April 16, 2024

April 10, 2024

March 29, 2024

February 28, 2024

February 22, 2024

December 14, 2023

October 31, 2023

October 12, 2023

August 9, 2023

May 24, 2023

April 25, 2023

March 16, 2023

February 9, 2023

January 23, 2023